The Perfect Storm Behind Rising Rates

Insurance rates are climbing faster than ever before. If you’ve received a renewal notice recently, you might have experienced significant sticker shock. But what’s driving these unprecedented increases?

As independent insurance professionals, we wanted to provide some transparency about what’s happening behind the scenes in our industry. The current crisis isn’t the result of insurance companies simply seeking higher profits—it’s the outcome of a “perfect storm” of economic factors.

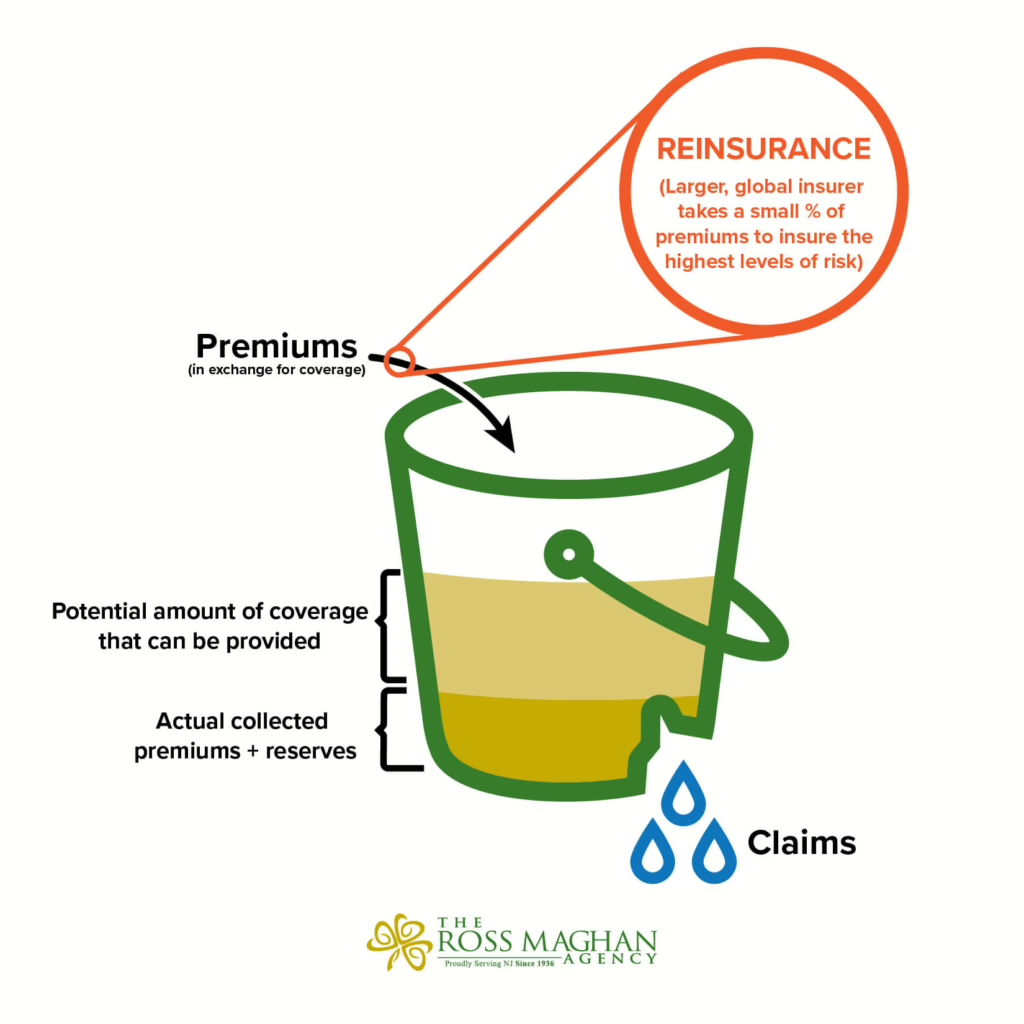

The Insurance Bucket Analogy: Understanding How Insurers Manage Risk

Think of an insurance company as a bucket filled with money. Premiums flow in from the top, while claims leak out from the bottom. Actuaries—those “fancy smart math people”—calculate exactly how much should flow in to offset what leaks out, plus enough to keep the company profitable.

For decades, this system worked relatively well. If one insurance company raised rates, competitors would step in to offer better pricing, creating a balanced marketplace for consumers.

Three Major Factors Behind the Insurance Crisis

Three major factors have converged to create the current crisis:

Interest Rate Impacts

When the government raised interest rates to control inflation, it decreased the value of insurance companies’ bond holdings. Suddenly, their financial reserves shrank without writing a single new policy.

Reinsurance Constraints

The global reinsurance companies that allow insurers to take on more risk started asking, “Why risk capital on unpredictable weather events when we can get safer returns from government bonds?” This shrinking capital pool has drastically increased costs.

Property Value Explosion

The value and replacement cost of properties increased far faster than insurance companies’ inflation expectations. A house that was adequately insured in 2020 might now be severely underinsured despite nominal coverage increases.

Regulatory Challenges: Why Insurance Companies Are Losing Money

Unlike commercial insurance, personal insurance rates are tightly regulated by states. During COVID, many states prohibited or severely limited rate increases to protect consumers. While well-intentioned, this regulatory pressure has created a situation where many companies are losing more than a dollar for every premium dollar collected.

Facing unsustainable losses, companies have few options: restrict new business, implement rigorous property inspections, or exit markets entirely. We’re seeing all three strategies play out across the country.

What’s Next? How to Navigate Rising Insurance Costs

In the next post, we’ll explore what this means for consumers and share strategies for navigating this challenging insurance landscape.

In the meantime, contact The Ross Maghan Agency today at (732) 566-0003 to discuss your insurance needs and get a personalized quote that perfectly fits your situation.